City Council last week ordered a feasibility study for a possible fire service fee. Beginning in mid-2026 at the earliest, the fee could be to billed to all or almost all city service customers within Statesboro, including tax-exempt properties, as a funding source for the Statesboro Fire Department.

At this point, officials don’t know what the rates would be or how much revenue the fee would generate – or if they will impose a fee at all.

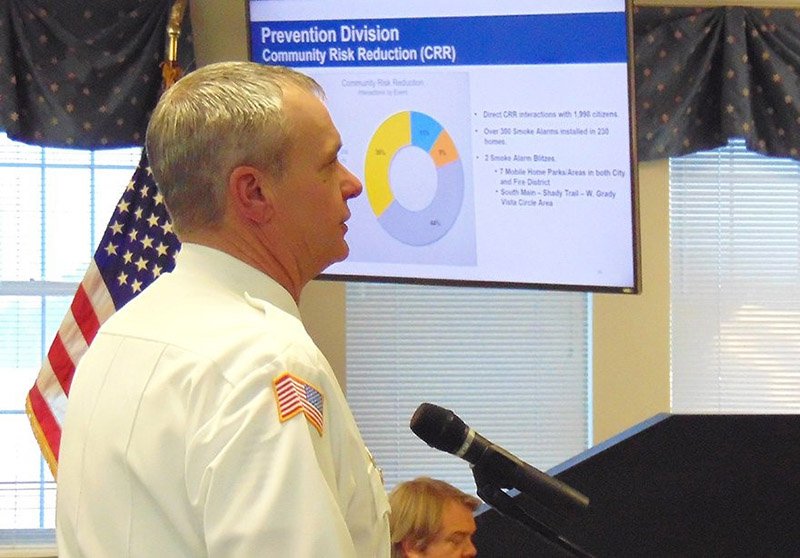

Statesboro Fire Chief Tim Grams led a brief presentation on the idea during the 3:30 p.m. Tuesday, Jan. 28, mayor and council work session. Council members then voted 4-0 during the 5:30 p.m. meeting to accept City Manager Charles Penny’s recommendation and contract with the engineering and planning consultant firm Goodwyn Mills Cawood, or GMC, to conduct the study for $60,000.

Two days later, a contentious negotiating meeting of county and city officials underlined the possibility that the longstanding arrangement under which the SFD has served an area of Bulloch County to almost five miles outside the city limits will end June 30.

That would mean a loss of at least $2.3 million in revenue for the city Fire Department. The county-collected fire service property tax in the Statesboro Fire Tax District is supplying about 30% of the SFD’s $7.68 million total fiscal year 2025 budget.

However, Statesboro officials have talked about a fire fee before, Penny noted in reply to emailed questions Friday. With the five-year intergovernmental agreement on the fire district set to expire June 30, 2025, city officials mentioned it last spring during their budgeting process for the current fiscal year.

“We have discussed it for a number of years; however, during the budget process, I knew the Fire Agreement was near its end and just in case the county decided to terminate it, the fee would provide a revenue option,” he wrote. “I stated that at the City Council budget work session.”

Then the Bulloch County Board of Commissioners in December voted to terminate the fire district service agreement effective with its June 30 end date, rather than having it renew automatically. This was done with a notice to the city seeking to negotiate a new agreement.

During the Thursday, Jan. 30 meeting of the Statesboro Fire Tax District Committee, Chief Ben Tapley of the Bulloch County Fire Department laid out the county government’s proposal for a new agreement. This would be a one-year transitional agreement, with the county department to take on half of the five-mile district and receive half of the potential revenue from July 1, 2025 until June 30, 2026, before assuming responsibility for the entire district July 1, 2026.

‘More relevant now’

Other details from the discussion are reported in a separate story. But Penny told county officials early in the meeting that rather than accept those terms he would advise City Council to end the agreement June 30, 2025. Or rather, as he said later, he would advise the council to allow the contract termination the county initiated to take effect.

“I recommend the City Council accept the decision of the Bulloch County Commissioners at their December meeting, when they voted to terminate the agreement. … The County decided to cancel the agreement, not the City,” Penny stated in an email Friday to the Statesboro Herald’s reporter.

One question emailed back to Penny was whether the potential loss of revenue from the fire service district, especially after the county’s proposal was presented Thursday, made the reasons for the fire fee feasibility study more urgent.

“It makes it more relevant now than ever,” Penny wrote. “We don't even know if it is feasible and that is the first phase of the project, which will take about six months to determine. And if feasible, it may be possible to be in place by July 1, 2026.”

Another consideration is that a federal funding source for the pay of 12 of the Statesboro Fire Department’s firefighters is set to end in another year. In February 2023, the department and city were awarded a $2.1 million Staffing for Adequate Fire and Emergency Response, or SAFER, grant to add those 12 firefighters. The grant covers their original salaries and benefits and for three years.

Chief’s pitch for the fee

A number of local governments in Georgia have implemented “some version of a fire service fee,” according to Grams. He listed McDuffie County and Chatham County, as well as the city of Perry in Houston County and the cities of Bloomingdale, Port Wentworth and Garden City, which are all in Chatham County, as examples.

“Utilizing a fire fee, versus traditional property tax, is a more equitable way to fund the fire service, because that fee would apply to all users of the service, including tax-exempt properties,” Grams asserted in his remarks to City Council.

“I think we all are aware that Statesboro has a tremendous amount of tax-exempt properties,” he said. “These properties basically are generating calls and demands on the fire service, but in essence are not really contributing to its funding.”

With the Georgia Southern University campus and local schools, tax-exempt nonprofit organizations, churches and the county government, city government and judicial circuit buildings, between 25% and 30% of the real estate in Statesboro, by value, is tax-exempt, according to the city’s data.

City officials also cited the inclusion of tax-exempt properties as an argument for Statesboro’s creation of a “stormwater utility” 10 years ago. Used to fund improvements and maintenance of the drainage system, the stormwater fee continues to be collected through the city’s monthly bills.

As with that fee, the fire service fee would actually be a set of fees, varying with types of property. Tasks assigned to Goodwyn Mills Cawood for the feasibility study include analysis of property uses and fire protection needs to create “risk classes,” as well as analysis of the cost of current and projected future service and a comparison of the possible fee with property tax funding.

GMC is the same engineering and planning consultant firm that recently completed the Statesboro-Bulloch County Long-Range Transportation Plan.

The consultants are expected to take six months to complete the feasibility phase of the study. But if the mayor and council decide to implement a fee structure, the city would take until the start of the next fiscal year in mid-2026 to implement it, as Penny said.